Maximizing Benefits for Veteran Owned Businesses

Are you a Veteran trying to start or grow your own business? While running a business of any size can be a daunting task, the US government has implemented numerous programs to help Veteran-owned businesses succeed. From loan guarantees to business counseling services, this article will explore the multitude of benefits available to help you make the most of your business venture. So, let’s take a closer look at the different opportunities available to Veteran-owned businesses!

Veteran owned businesses can gain numerous benefits from government programs which provide resources and incentives for their success. The Services-Disabled Veteran Owned Small-Business (SDVOSB) program promotes veteran owned businesses to succeed in the competitive market by offering a variety of incentives, such as access to capital, government contracts and purchasing preferences. Additionally, the Small Business Administration (SBA) provides veteran owned businesses with loan programs and financial counseling. Other federal and state programs exist to offer additional assistance to veterans, including specialty certifications and tax incentives.

In general, local, state, and federal governments often want to invest in veterans and promote their businesses. Many special certifications exist, such as those for Service-Disabled Veteran-Owned Businesses (SDVOBs) and the Veterans Access, Choice, and Accountability Act (VACAA), which provide veteran-owned companies with preferences when competing for government contracts. These programs also provide assistance with obtaining licenses, access to capital, and specialized training. Additionally, many veteran business owners are eligible for tax-related benefits, such as incentives and tax credits.

Overall, veteran business owners have access to a range of resources and incentives which can be beneficial and help their business succeed. All veterans should consult their local government’s office of veterans affairs to determine which benefits and services they are eligible to receive.

What incentives are available for veteran-owned small businesses?

Veteran-owned small businesses have a unique set of needs and challenges and many states and localities offer incentives to help them succeed. Tax credits, grants, low-interest loans, access to government contracts, and specialized technical assistance are just some of the incentives available to veteran-owned small businesses. In addition, veteran-owned small businesses may be eligible for priority access to government services, preferential treatment for bidding on government contracts, waived fees for business licenses and permits, access to free or discounted training programs, business incubator programs, mentorship and networking opportunities.

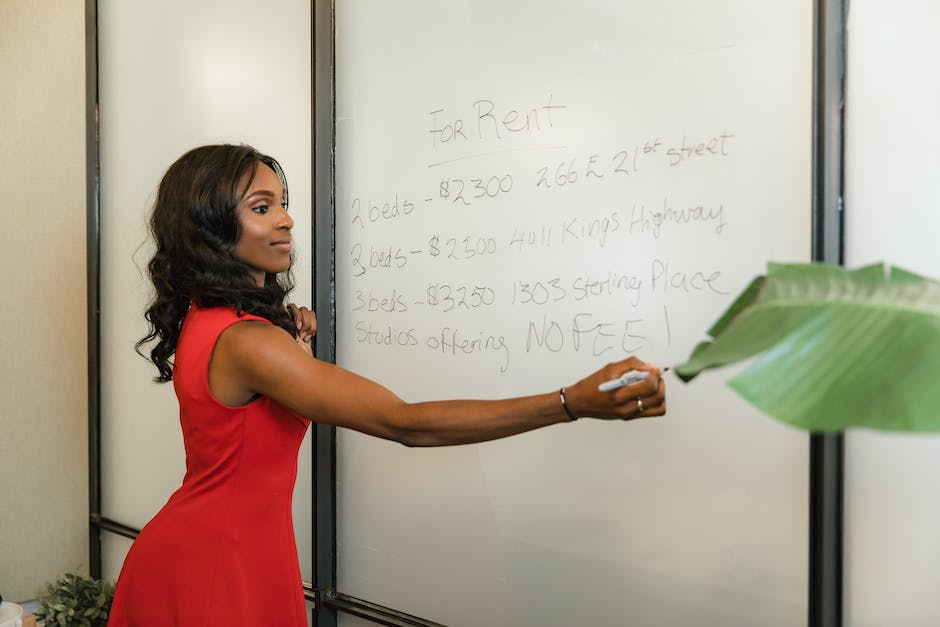

For those looking for more specific incentives, many states and localities have created programs that are tailored to the needs of veteran-owned small businesses. For example, in California, the California Veterans Business Program offers a variety of services to help veteran-owned small businesses start, operate and grow, including access to capital, government contracts, mentorship and marketing assistance. Similarly, in New York, the Veteran Economic Empowerment Program provides a variety of services to help veteran-owned small businesses start and grow, including access to capital, technical assistance and access to contracts.

The incentives available to veteran-owned small businesses vary by state and locality, so it is important to research the specific incentives in your area. By taking advantage of the incentives available, veteran-owned small businesses can gain access to the resources and support they need to succeed.

Veteran-owned businesses can take advantage of a wide variety of incentives depending on their state and locality. Tax incentives, grants, loans, procurement preferences, and networking opportunities are some of the most common incentives available. These incentives can help veteran-owned businesses to start up, expand, and succeed. For example, many states offer tax incentives to veteran-owned businesses such as reduced sales and income taxes, reduced property taxes, or even tax exemptions. On the other hand, grants can help veteran-owned businesses with start-up costs or to expand existing businesses. The Small Business Administration and other government programs also offer special loans to veteran-owned businesses. Furthermore, many government agencies and some private companies give preference to veteran-owned businesses when awarding contracts. Finally, veteran-owned businesses may be able to take advantage of networking opportunities with other veteran-owned businesses and organizations. Therefore, veteran-owned businesses should take advantage of the wide variety of incentives available to them.

What incentives are available for veteran-owned businesses

For veteran-owned businesses, incentives and resources vary widely by state and locality. States and localities offer a variety of incentives to help veteran-owned businesses get started or expand their operations, including tax credits and exemptions, grants, loans, procurement preferences, and mentorship programs. Tax credits and exemptions can help reduce the cost of doing business, while grants, loans, and procurement preferences can provide much-needed capital to help fund operations. Mentorship programs can provide invaluable resources, advice, and guidance from experienced business owners who have been in the same position as the veteran-owned business. With these incentives and resources, veteran-owned businesses can succeed and thrive in the marketplace.

Veteran-owned businesses have access to a variety of incentives depending on the state they are operating in. These incentives range from grants and tax credits to loans, priority access to state contracts, and more. States also offer specialized training programs, mentorship opportunities, discounted business registration fees, and access to business incubators and accelerators. This can provide a great opportunity for veterans to launch and grow their businesses with support from the government.

To make it easier for veterans to take advantage of these incentives, some states have created specialized programs and resources tailored specifically to veteran-owned businesses. In Arizona, for example, the Arizona Department of Veterans’ Services provides a range of resources, including business counseling and training, access to capital, and more. Similarly, in Florida the Florida Veteran Business Initiative provides an array of services, such as counseling, training, workshops, and access to capital.

The following table provides a summary of the various incentives available for veteran-owned businesses across the United States.

| State | Incentives |

|---|---|

| Arizona | Business counseling and training, access to capital |

| Florida | Counseling, training, workshops, access to capital |

| Georgia | Grants, tax credits, business loans, priority access to state contracts |

| Illinois | Grants, tax credits, discounted business registration fees, access to business incubators and accelerators |

Veteran-owned businesses have access to a variety of incentives that can help them get their businesses off the ground and grow. It is important for veterans to be aware of the incentives available in their state, so they can make the most of the resources available to them.

What kinds of incentives are available for veteran-owned businesses?

Veteran-owned businesses have access to numerous incentives from the federal, state and local governments. These incentives are designed to help veterans start, grow and expand their businesses. One of the most common incentives is tax credits, which can provide a financial boost to veterans struggling to keep up with their expenses. Some states also offer special grants and loan guarantees, allowing veterans to access capital to help fund their businesses. Additionally, veterans may be able to access government contracts through the Veterans First Contracting Program, which sets aside certain federal contracts specifically for veteran-owned businesses.

Other incentives for veteran-owned businesses include specialized training and mentorship programs, which can help veterans gain the skills and knowledge necessary to run a successful business. Many states also have resources available to help veterans with marketing, accounting and other business-related tasks.

For veterans looking to start or expand their business, the incentives available from the federal, state and local governments can make all the difference in their success. With the right combination of tax credits, grants, loan guarantees and access to government contracts, veterans can get their businesses off the ground and achieve their long-term goals.

Veteran-owned businesses can benefit from numerous incentives depending on the state and locality in which they are operating. From tax credits and deductions to preferential access to government contracts and access to military-specific resources, veteran-owned businesses can access a variety of helpful resources. Business owners can also benefit from grants and loans, specialized technical assistance and counseling, business development resources, mentorship programs, networking opportunities, waivers of certain fees, preferential access to capital, business incubators and accelerators. All of these incentives can help veteran-owned businesses to succeed in their industry and grow their businesses. By taking advantage of these incentives, veteran-owned businesses can be successful in the current business environment.

What incentives are offered to veteran-owned businesses?

Veterans have made great sacrifices in their service to our nation, so it is important to recognize and honor their contributions in ways that help ensure their ongoing success long after their service. Fortunately, there are a variety of incentives for veteran-owned businesses that are offered at the state and federal level. These incentives typically include tax credits, access to capital through preferential bidding on contracts, small business loans and grants, and specialized business development programs that offer access to mentors, additional resources, and technical and marketing assistance.

The U.S. Small Business Administration offers an array of programs specifically for veteran-owned businesses. The Veteran Entrepreneur Portal is a platform that helps veteran entrepreneurs to develop and grow a business, while the Boots to Business program provides an introduction to entrepreneurship, focusing on the basics of starting, managing and building a business. Both of these programs have proven successful in helping veterans transition from their time in the military to becoming small business owners.

By considering the various options, veteran-owned businesses can make the most of the incentives offered by the state and federal government and ensure that they have all the resources they need to thrive and be successful.

Many veterans have made the brave decision to take their experiences and create a business. To provide them with the support they need, the federal government has put forth several programs to help veteran-owned businesses succeed. Programs such as the Small Business Administration’s Patriot Express Loan Program, the SBA’s Boots to Business program, the Veteran Entrepreneur Portal, and the Veteran-Owned Small Business Procurement Program provide veterans with funding and resources to start or expand existing businesses. Additionally, many states across the United States have incentive programs to help veteran-owned businesses access capital and gain a foothold in their respective economies.

These programs are often based on creditworthiness and other qualifications, and may include grants, the ability to apply for zero-interest loans, access to discounted resources, and additional ways to increase the visibility of veteran-owned businesses. Through the combined efforts of these federal and state programs, veterans are gaining greater opportunities for success in the business world.

This dedicated support for veteran-owned businesses is an invaluable resource for those looking to start or grow a business. It is helping veterans to capitalize on their experiences and create their own legacies, while also providing a much-needed boost to the US economy.

What incentives are available to veteran-owned businesses

To assist veteran-owned businesses in their efforts to succeed, various incentives are available to them at the federal, state, and local level. Eligible veterans can secure tax credits such as Work Opportunity Credit (WOTC), Disabled Access Credit (DAC) and Federal Contracting programs. Additionally, veterans have access to capital through grants and loans. The Small Business Administration and Department of Veterans Affairs offer grants and low-interest loans to veterans that won’t need to be paid back, making it easier to pursue business opportunities.

In addition to financial support, veteran-owned businesses could also benefit from a range of business services. For instance, many states and localities offer incentive programs such as reduced licensing fees and expedited permitting processes. Furthermore, specialized training and counseling is available through government and state agencies as well as through private organizations that specialize in helping veteran-owned businesses get up and running.

To sum it up, there are a variety of incentives available to veteran-owned businesses. This includes tax credits, government contracts, access to capital, grants and loans, and specialized business services. Additionally, many states have created local programs to provide additional incentives and services to veteran-owners. Together, these incentives can enable veteran-owned businesses to gain a competitive edge and lay the groundwork for their success.

| Incentive Program | Description |

|---|---|

| Tax Credits | Includes Work Opportunity Credit (WOTC) and Disabled Access Credit (DAC) |

| Government Contracts | Securing of federal contracts available to veteran-owned businesses |

| Access to Capital | Grants and loans offered by the Small Business Administration and Department of Veterans Affairs |

| Business Services | Specialized training and counseling available through government and state agencies as well as private organizations |

The Small Business Administration (SBA) offers an array of programs for veteran-owned businesses to take advantage of, such as the Veterans Business Outreach Centers (VBOCs) which offer counseling, training, and mentoring. Through SBA’s Procurement Technical Assistance Centers (PTACs), veteran-owned businesses may receive free assistance to do business with the government. Additionally, the Veterans First Contracting Program sets aside government contracts for veteran-owned businesses and the Service-Disabled Veteran-Owned Small Business (SDVOSB) Program supports contracting needs of veteran-owned businesses owned by service-disabled veterans. Finally, the Military Reservist Economic Injury Disaster Loan Program (MREIDL) provides low-interest loans to veteran-owned businesses affected by military service. As anyone can see, the SBA works to provide veteran-owned businesses with the resources they need to achieve success and become self-sufficient.

What incentives are available for veteran-owned businesses?

The incentives available to veteran-owned businesses and entrepreneurs are numerous and vary greatly by state. In states such as New York, entrepreneurs with a military background are eligible for grants of up to $50,000 through the Veteran Access to Entrepreneurial Opportunities program. In Illinois, veteran-owned businesses can realize tax credits of up to $2,500 per location and gain access to state contracts set aside for veteran-owned businesses. At the federal level, the Small Business Administration’s (SBA) Veterans Advantage program provides loan guarantees and other assistance to assistance to veteran-owned businesses. Furthermore, the SBA’s Boots to Business program, specifically designed for veterans, provides free training and mentoring to veteran entrepreneurs.

In order to make the most of the incentives available to veteran-owned businesses, employers should research their options both at the federal and state level to find the assistance best suited for them. Table 1 below outlines some of the more common incentives for veteran-owned businesses across the United States:

| Incentive | Description |

|---|---|

| State Grants | Grants up to a certain amount, typically awarded through local SBA office. |

| Tax Credits | Financial aid or credits given to veteran-owned businesses, usually based on number of employees. |

| Loans and Loan Guarantees | Loans or loan guarantees to veteran-owned businesses via Small Business Administration’s veterans advantage programs. |

| Boots to Business Program | Free training and mentorship to veteran-owned businesses. |

| Reduce Fees | Discounts on state licenses, permits and other fees. |

| Special State Contract Opportunities | State contracts set aside for veteran-owned businesses. |

The incentives available to veteran-owned businesses and entrepreneurs provide viable resources with which to reduce the cost of setting up and maintaining a business. With the variety of tax credits, loan programs, grants, and other forms of assistance, it is possible for the veteran-owned business to take advantage of the existing infrastructure and resources available to them. Regardless of where a veteran-owned business is located, research and exploration of funding possibilities are key to maximizing the benefits available.

VA-certified veteran-owned firms have access to many benefits and incentives specifically geared towards their businesses. The most common incentives offered can be broken down into three core areas: tax credits, grants, and low-interest loans.

Tax credits are available to veteran-owned firms from the federal government, states, and private sector in order to reduce the business’s tax liability. For example, in Maryland, veteran-owned firms may receive the Small Business Job Creation Tax Credit, which grants a tax credit of up to $3,000 per qualified employee hired.

Grants are also available to veteran-owned businesses, often in the form of research and development grants, incubation grants, and others. The Small Business Innovation Research (SBIR) program is a federal program that provides grants to “support scientific excellence and technological innovation through the investment of federal research funds in critical American priorities to build a strong national economy.”

Low-interest loans are a great form of assistance for veteran-owned businesses. The terms of the loans vary depending on the state, but a common offering is the Small Business Administration (SBA) 7(a) loan, which provides businesses with access to capital in the form of a low-interest loan.

In addition to the three core areas outlined above, veteran-owned businesses have access to various other incentives. This includes preferential bidding, access to government contracts, free or reduced-cost business counseling, mentoring and networking opportunities, waived licensing fees, free or reduced-cost office space, access to technical assistance and a variety of other resources and events. These incentives help level the playing field for veteran-owned businesses and give them the edge they need to succeed.

What incentives are available to support veteran owned businesses

As a veteran-owned business, you have access to a variety of incentives that can help you grow and sustain your business. Through government-sponsored initiatives, you can access tax credits, grants, loan guarantees and special contracts that could help lower the costs and risks associated with forming and maintaining your business. Additionally, the Small Business Administration (SBA) offers a wide range of resources specifically designed to benefit veteran-owned businesses, including financial assistance, specialized educational programs, and mentoring services. Furthermore, many states provide additional incentives, such as discounted fees and special contracts, to help further support veteran-owned businesses. With the support and incentives available, veterans have the opportunity to get the most out of their business endeavors and build a successful enterprise.

Incentives for veteran-owned businesses vary by state and can be a powerful tool to help business owners in need of financial or technical assistance. Certain states are providing earnest support to veteran-owned businesses in the form of access to capital, tax credits, grants, or other assistance. Some of the most common incentives that veteran-owned businesses may benefit from include access to government contracts and subcontracts, tax credits for hiring veterans, preferential bidding on government contracts, plus grants to cover start-up and expansion costs.

Discounted or free access to government resources, business resources, and/or professional licensing are also often offered as part of the package. Businesses may even be able to access mentoring and technical assistance programs and networking opportunities to help entrepreneurs develop their businesses successfully. All these incentives offer veteran-owned businesses critical access to the tools and financial resources to fully participate in the economy and compete in the marketplace.

For added convenience, the following table provides a visual summary of some of the common incentives that veteran-owned businesses may avail of:

| Incentive | Description|

|——|————|

| Access to Government Contracts | Preference in contracts and subcontracts, preferential bidding |

| Tax Credits for Hiring Veterans | Lower taxes when veterans are hired, lower net income |

| Grants for Start-up and Expansion Costs | Free money to cover certain costs |

| Access to Mentoring and Technical Support Programs | Assistance with various aspects of business |

| Waived or Reduced Fees for Business Licenses and Permits | Cost savings on license and permit applications |

| Waived or Reduced Fees for Professional Licensing | Cost savings on professional license applications |

| Networking and Business Development Opportunities | Linking with different businesses and mentors |

| Discounted or Free Access to Business Resources | Resources such as tools and advice |

| Discounted or Free Access to Government Resources | Data sets, videos, and more |

Thus, veteran-owned businesses in nearly all states have access to some form of incentives that can be beneficial in helping them succeed. By recognizing and utilizing these opportunities, entrepreneurs can build thriving businesses.

What incentives are available for veteran-owned small businesses?

Veteran-owned small businesses have a great opportunity to access a variety of incentives that can really help jump-start and grow a new business. For example, many states offer tax credits and exemptions to businesses that hire veterans. This can help businesses save on employment costs while also helping to provide career opportunities to veterans. Additionally, veteran-owned businesses are often given preference with government contracts and provided with access to networks and resources specifically designated to help them succeed. Moreover, veterans may be eligible for grants and loans to help launch their business, as well as waivers for certain business fees and regulations. Finally, there are opportunities for veterans receiving financial assistance for start-ups costs, venture capital and angel investor networks, mentoring and training programs, and more.

For veteran-owned businesses, there are numerous opportunities to take advantage of monetary and nonmonetary benefits. Tax incentives, government contracts, grants, financing, and mentorship are all available for those who qualify.

Tax incentives may include reduced taxes or tax credits for hiring veterans, which help to offset the cost of running a business and increase their profits. Government contracts are available, because the federal government has a program to give preference to veteran-owned businesses when awarding contracts. Grants are also available through the Small Business Administration (SBA) to help veteran-owned businesses start, expand, or modernize their operations. The SBA also offers financing through its Patriot Express Loan Program, which provides financing of up to $500,000 to veteran-owned businesses. Additionally, there are mentorship programs to help veteran-owned businesses get off the ground and succeed.

Organizations like the US Chamber of Commerce’s Hiring Our Heroes, the Boots to Business program by the Department of Defense, and Veteran Institute are just some of the available programs that exist to help veterans start their own businesses and succeed in the long run. All of these programs offer support and resources for veteran-owned businesses to take advantage of, making them a great option for those wanting to start their own business.

Wrap Up

Veteran-owned businesses come with a multitude of benefits, giving veterans an opportunity to create, build, and operate their own business. Some of the benefits include:

– Financial Assistance: Many local and federal organizations provide grants, loans, loan guarantees, and other financial resources to veteran-owned businesses.

– Preferential Hiring: Veteran-owned businesses often receive certain hiring preferences, allowing them to hire veterans (both disabled and non-disabled) as well as other eligible veterans’ survivors.

– Access to Technology: Federal agencies often provide veteran-owned businesses with access to cutting-edge technology, including tools to support research, development, and production.

– Marketing and Networking Opportunities: Veteran-owned businesses have access to specific marketing and networking opportunities to help them make connections with other veteran-owned businesses and customers.

– Tax Incentives: Veteran-owned businesses can take advantage of various tax benefits, including deductions, credits, and more.

– Special Events: Veteran-owned businesses may be invited to participate in special events such as trade shows and seminars, giving them access to valuable resources and potential customers.

## FAQs

### What are the benefits of being a Veteran-Owned Small Business?

There are numerous benefits to being a Veteran-Owned Small Business (VOSB). These include access to federal contracting opportunities, potential tax credits and reduced fees, discounted certifications, marketing and visibility, and business advice and training resources. Additionally, there are many programs that allow veterans to take advantage of federal and/or state-specific benefits and provide them with access to capital.

### Are there any government-related opportunities available to veteran business owners?

Yes, there are many government-related opportunities available to Vet-Owned Small Businesses. These include accessing government contracts, taking part in SBA’s small business contract set-asides, and small business contracting certifications. The SBA also offers Vet-Biz, a certification process for veteran-owned small businesses, which can be used to access subcontracts. Additionally, certain states offer additional benefits such as tax credits and other incentives.

### Is there help available for veteran small business owners?

Yes! VOSBs can access help from veteran-specific groups, the Small Business Administration (SBA), and certain state-specific programs. The SBA offers various initiatives and programs to assist veterans, from training and counseling to specialized loan and contracting initiatives. Specialized services provided by veteran-specific organizations such as Veteran’s Forward, Bunker Labs, and Vets4Vets can also provide support to VOSB owners. Furthermore, there are numerous online forums, podcasts, and blogs that offer assistance, advocacy, and resources.

### How can I learn more about veteran-owned small business benefits?

There are a variety of resources available to help veteran-owned small business owners learn more about the benefits they can take advantage of. The federal government and individual states offer a variety of helpful websites, such as the Small Business Administration’s Veterans Entrepreneur Portal, and Vet-Biz, which outlines eligibility requirements for a variety of federal and state-level programs. Organizations such as Veteran’s Forward and Bunker Labs also provide a broad range of information and support for veteran-owned businesses. Additionally, numerous industry-specific websites, syndicated webinars, and newsletters can provide valuable information on industry-specific programs and resources.

## Conclusion

Veteran-owned small businesses can benefit from a variety of government-specific resources and programs. These include access to federal contracting